- 26 Jan 2024

- 3 Minutes to read

- Print

- DarkLight

Payouts

- Updated on 26 Jan 2024

- 3 Minutes to read

- Print

- DarkLight

Payouts

Net Settlement for Merchants

As part of our standard set up, all merchants are configured for net settlement. This approach means that any transaction fees, refunds, and chargebacks are deducted from your payment totals before the funds are transferred to your account.

Special Provision for Schools

Educational institutions have a unique option: they can choose to manage refunds and chargebacks through direct debit, offering an alternative to the standard net settlement deductions.

Understanding Your Remittance Schedule with Evolve

By default, Evolve schedules the initial remittance one working day after the first successful payment. Afterwards, merchants receive remittance of funds every working weekday.

Alternatively, Evolve's Flexible Remittance allows ISVs to control the frequency of fund remittance to merchants.

You can see information on the schedule being used for your merchant account in the Merchant Portal Payouts screen ‘Remittance Mode’

.png)

Evolve Portal

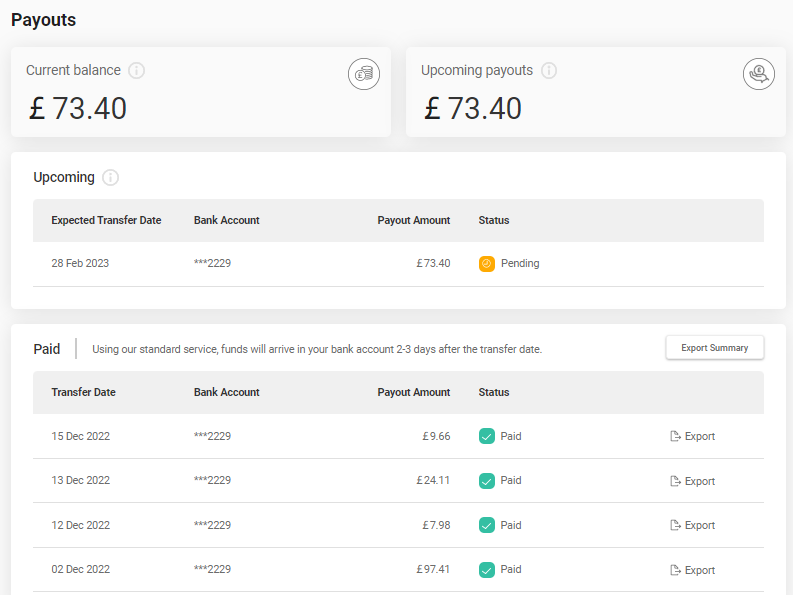

The Payouts tab lets you view your current balance, upcoming payouts and paid payments, as well as export payout data summary and breakdowns, allowing you to reconcile these with your bank statements.

Click on a row in the Upcoming or Paid sections to view a summary breakdown of the payout including Payments and Credits,Transaction Fees and Refunds, Adjustments and Fees.

Payments and Credits This will show a total of your Customer Payments, Credit Chargebacks and Chargeback Reversals that will be paid into your account.

Transaction Fees This will show a total of the Access PaySuite Transaction fees that shall be recovered from you against the Customer Payments.

Refunds, Adjustments and Fees This will show a total of Refunds, Chargebacks, Chargeback Fees and Credit Chargeback Reversals that will be recovered from you.

How to reconcile

Understanding the exact payout amounts settled to you is a crucial part of your business's bookkeeping process.

In order to reconcile, as a first step, compare your bank statement with the payouts tab on the Merchant Portal to verify that you’ve received all the payouts shown in the Paid section of the tab.

You can download a summary of these payments to an Excel file with the Export Summary button.

The summary shows the Transfer Date, Bank Account, Payments and Credits, Transaction Fees, Refunds/Adjustments & Fees, Payout Amount and Status.

For more detail on individual payouts, you can download a breakdown of each by clicking the Export button to the right of each payout in the Paid section. An individual payout contains all of the transactions processed in one 24 hours period, from 22:15 UCT to 22:15 the next day. Note that during British Summer Time, 22:15 corresponds to 23:15 BST.

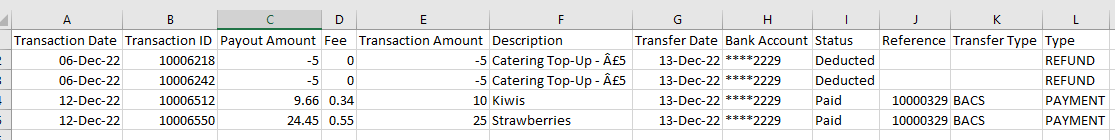

If your payout consists of multiple transactions these will be displayed in the payout file. For example, if there were multiple payouts and/or refunds these will all be shown.

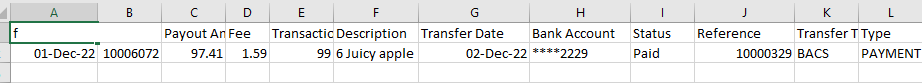

Each payment/refund will be shown with the following transaction date, ID, payout amount, fee, transaction amount before fee, transfer date, bank account, status, reference, transfer type and type.

Payouts file example

Payouts files contain details of all transactions for the remittance period, which is usually a period of 24 hours from 22:15 to 22:15 UTC. preceding the remittance run. For merchants using OnDemand Settlement, the remittance period will be determined by the ISV. The following is an example of a payout file containing just one payment.

The following is an example of a payout file containing four transactions, consisting of two payouts and two refunds:

Transactions tab

You can also check transactions on the transactions tab against payouts.

For more information, see Transactions

Arrival date

Payouts will arrive in your bank account according to the time when they are received. If they are received before 22.15 on a working day, they will be sent out on the remittance run of that day, which typically occurs within a few hours, and depending on your bank's clearing time, should appear in your bank account within 2-3 working days. Transactions made over the weekend will be received on Monday. See the table in Payout Schedules example below for more detail.

Status for the files

Status |

Paid |

Deducted |

|

Transaction Status |

Successful |

Failed |

Payout Schedule

The following tables are examples of typical Payout schedules using BACS and Premium Faster Payments Settlement. The actual time you receive your payout will depend on your bank's clearing schedule.

Standard: BACS settlement timeline

| Access PaySuite initiates Payout | Payout received by Merchant |

Monday - Week 1* | Tuesday - Week 1 | Thursday - Week 1 |

Tuesday - Week 1* | Wednesday - Week 1 | Friday - Week 1 |

Wednesday - Week 1* | Thursday - Week 1 | Monday - Week 2 |

Thursday - Week 1* | Friday - Week 1 | Tuesday - Week 2 |

Friday - Week 1* | Mon Week 2 | Wednesday - Week 2 |

Saturday - Week 1* | Mon Week 2 | Wednesday - Week 2 |

Sunday - Week 1* | Mon Week 2 | Wednesday - Week 2 |

*Transaction cut-off is 22:15

Premium: Faster Payments settlement timeline

| Access PaySuite initiates Payout | Payout received by Merchant |

Monday* | Monday | Tuesday |

Tuesday* | Tuesday | Wednesday |

Wednesday* | Wednesday | Thursday |

Thursday* | Thursday | Friday |

Friday* | Friday | Monday |

Saturday* | Monday | Tuesday |

Sunday* | Monday | Tuesday |

*Transaction cut-off is 22:15