- 01 Mar 2024

- 1 Minute to read

- Print

- DarkLight

Card processing overview (Direct Checkout)

- Updated on 01 Mar 2024

- 1 Minute to read

- Print

- DarkLight

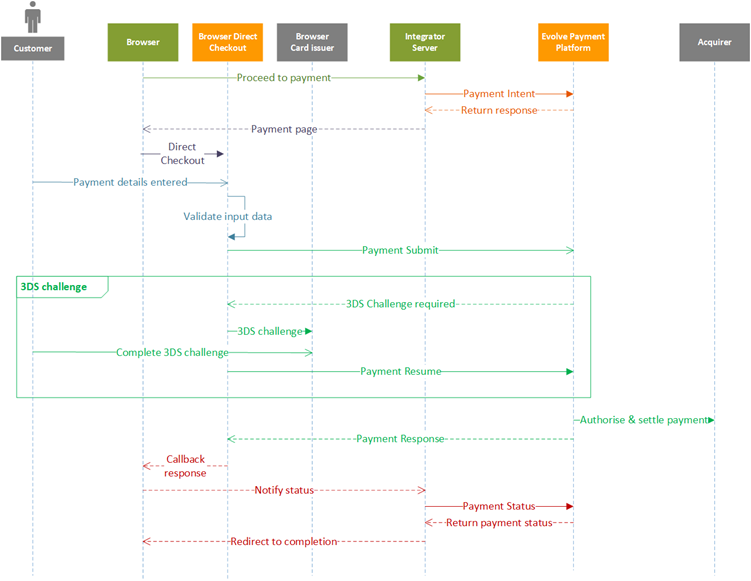

Processing a card payment will involve the following steps:

When your customer is ready to make a payment, you will need to send a payment intent request to the Evolve Payment Service (EPS) endpoint.

Redirect the cardholder to your payment page and pass the information returned from this request into the Direct Checkout payment method.

The payment page will be populated with the appropriate controls for taking the cardholder information.

The cardholder fills in their details and submits the payment.

Direct Checkout will process the payment request, including any 3D Secure challenges, and return a response to the page.

You will then need to poll the EPS endpoint to confirm the outcome of the payment.

The lifelines (roles) in the diagram are:

Customer | The payer that is making a payment through Direct Checkout. |

Browser | The HTML page on the Integrator’s domain that the payer has been redirected to by the Integrator Server. |

Browser Direct Checkout | The HTML page on the Access PaySuite domain that has been loaded by the Direct Checkout library within an iframe to securely capture payment data. |

Browser Card Issuer | The HTML page on the Card Issuer domain that has been loaded by the Direct Checkout library within an iframe to securely capture a 3D Secure challenge. |

Integrator Server | The Integrator server that is making the server-side calls to the Evolve Payment Platform and handling the interaction between their payment page that contains Direct Checkout. |

Evolve Payment Platform | The Evolve Payment Service (EPS). |

Acquirer | The Acquiring bank used to process payments. |